Lots of credit cards also carry variable premiums, which can cause the quantity you pay out in interest to fluctuate as prices change. Particular financial loans, on the other hand, usually offer set-level loans which will maintain your month-to-month payment dependable.

If you’re achieving the top on the thirty day period, payday is just round the corner, however, you’re out of cash; what do you are doing? You decide for a $100 financial loan, not surprisingly! A $a hundred personal loan is often the distinction between a handful of unpleasant times and residing Commonly until your upcoming payday comes all over. A $a hundred loan is also ideal for supporting you afford unexpected little charges without having disrupting your recent dollars move.

Idea We integrated charge card dollars improvements and payday financial loans on this listing as options, but we don’t propose them because of their large rates and costs, which can entice individuals inside a cycle of financial debt that’s hard to pay back again.

A variable APR can fluctuate As outlined by market place tendencies. Whilst a variable APR often begins out lessen than a hard and fast APR, it could enhance in the future — which might also bring about your month-to-month payments to increase.

Using Credible to examine your prices doesn’t affect your credit score. Here’s how it really works: Credible's prequalification process works by using a delicate credit score inquiry that lets you see individualized premiums without having you being forced to make an application for a loan.

These questions don’t affect your financial loan request but support us discover you added financial solutions without spending a dime. Do you've $10,000 or maybe more in bank card personal debt?

Payday lenders Really don't commonly report financial loans to the two credit bureaus in copyright, Equifax and TransUnion. On the other hand, if a missed payment is shipped into a collections company, it could be noted into the credit rating bureaus, which would then negatively effects your credit history rating.

Getting unsecured a hundred mortgage selections with undesirable credit is easier than you think that, especially when you utilize a financial loan System for example Viva Payday Loans. This certain financial loan-finder platform is building waves in the industry for its uncomplicated online application method and speedy processing. Here you will find unsecured loans, Despite undesirable credit rating, ranging from $a hundred to $5000 with as many as 24 months to pay.

Our on-line types are easy to fill out from your convenience of your very own household and might be concluded in minutes.

It's also well worth noting that if you develop an account with Albert, you'll be routinely enrolled from the Genius free of charge trial, which must be canceled just after thirty days if you do not need to shell out the total 12 months's membership price.

Brigit's Immediate Hard cash function offers a $250 money advance for qualifying Additionally associates. No credit history Verify is necessary, and Brigit rates no late service fees and doesn't request guidelines. It is also quite extremely recommended by consumers, which has a 4.

Effortless approval. Income advance and payday financial loan providers are lenient, get more info so whether you've fantastic or bad credit score, you can find approved for your $a hundred bank loan.

Congratulations it's time to begin stacking revenue. Make sure you Test your inbox with the confirmation e-mail.

Revolut won't provide a bank loan feature, but does contain the "Early Income" aspect, which lets you get your resources up to two times earlier than standard financial institutions If the income is connected by direct deposit for your Revolut account.

Alana "Honey Boo Boo" Thompson Then & Now!

Alana "Honey Boo Boo" Thompson Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Nancy Kerrigan Then & Now!

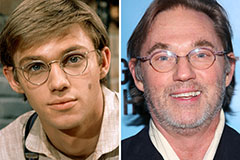

Nancy Kerrigan Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now!