Delight in cost savings with your monthly repayments by refinancing your existing loan. Get a home fairness loan

It's also possible to produce and print a loan amortization agenda to determine how your month to month payment pays-from the loan principal furthermore curiosity over the training course of your loan.

We use cookies to give you the very best knowledge on our Web page. By continuing to search This web site, you give consent for cookies for use. For additional information, make sure you read through our Privateness Policy.

With HSBC Team Home finance loan Protector, get pleasure from reasonably priced death, whole and permanent disability and terminal disease coverage to guard Your loved ones If your surprising occurs.

calculator. When you've got an existing loan, enter your curiosity level, monthly payment quantity and the number of payments are remaining to calculate the principal that remains on your own loan. Find the Interest Amount

Appreciate the flexibility to choose a hard and fast charge, floating rate, or a mix of the two. Decrease loan fascination along with your deposits

Develop and print a loan amortization timetable to see how your loan payment pays down principal and bank interest over the life of the loan.

Taking a look at this loan desk, It is simple to check out how refinancing or paying off your house loan early can really affect the payments of your three.7k loan. Increase in taxes, coverage, and maintenance expenditures to obtain a clearer image of General household possession expenses.

Determine the payment required to your loan amount of money and phrase. Come across your ideal payment total by transforming loan amount, curiosity price, and quantity of payments inside the loan.

Obtaining a home loan for a house is in fact pretty clear-cut. I recommend these ways. 1. Speak with your neighborhood bank. 2. Try out a property finance loan provider to see charges and obtain an on-line quotation. A home finance loan banker typically wants numerous decades of tax returns as well as a statement of your respective belongings and debts.

It's attainable that only one quarter of 1 percent can finish up conserving tens of countless numbers around the length of your loan. Also, beware any fees added towards the mortgage loan. This could vary tremendously according to the mortgage company.

Among the list of surprising issues I uncovered is how a little difference in fees can affect your full amount of money compensated. Try using the calculator to check various fascination rates.

Whether or not you're a very first-time household customer or aiming to refinance your present loan, we are listed here that can assist you discover a residence loan package deal which is good for you.

Mix preset and floating interest rates Get pleasure from both fiscal steadiness and flexibility by more info having section within your loan under a hard and fast rate, and the rest pegged to your floating rate.

They'll also want specifics of your home order. Typically, you're going to get an appraisal, a home inspection, and title insurance. Your housing agent or financial institution can arrange this for yourself.

Tatyana Ali Then & Now!

Tatyana Ali Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Christina Ricci Then & Now!

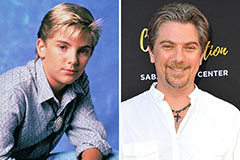

Christina Ricci Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now!